eCommerce website owners should rejoice! According to the May 2019 research of eMarketer, projected retail eCommerce sales for 2021 will rise to $4.927 trillion. And it will continue to increase to $5.695 trillion in 2022. Thus, total retail sales worldwide will experience an increase of 18.1% (2021) and 20.0% (2022).

Digital marketing truly has paved the way for online sellers to sell and market their goods and services to buyers. And retail eCommerce sales will continue to grow in the upcoming years. The online activities between sellers and buyers will boom the eCommerce industry.

- Why Are eCommerce Fraud Prevention Best Practices So Crucial?

- What Are eCommerce Fraud Attacks?

- Retailers Can Take These 3 Steps to Protect Their Brands

- Why Does eCommerce Fraud Take Place?

- Types of eCommerce Fraud Attacks

- eCommerce Fraud Prevention Best Practices

- Summary of eCommerce Fraud Prevention Best Practices and Techniques

Get an eCommerce Expert Consultation

Our Adobe Business Practitioner will audit and optimize your site for robust performance.

Why Are eCommerce Fraud Prevention Best Practices So Crucial?

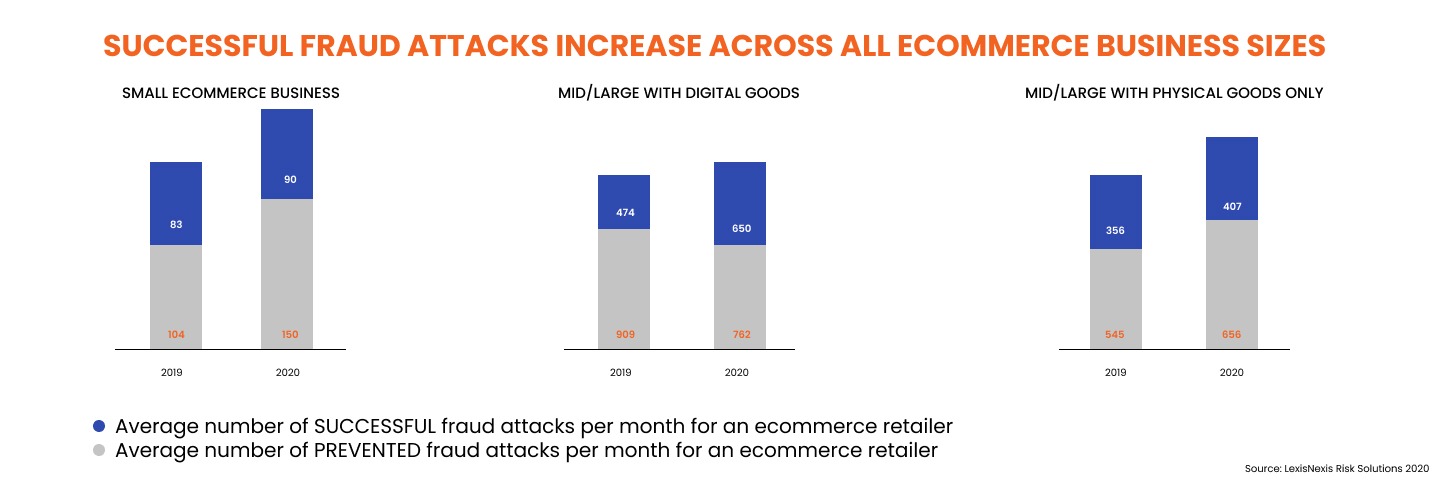

Unfortunately, with the further development of eCommerce, fraudulent activities will also increase. Per Signal Science’s November 2019 report, retailers will face about 206K web eCommerce frand attacks each month.

That’s why further security of private information must be put into place to avoid future incidents. This means that all website owners and users should learn more about the growing activities of eCommerce fraud. Owners should put into place eCommerce fraud prevention best practices across every part of their business.

They must also find eCommerce fraud solutions to reduce the number of online scammers attacking their business. With this eCommerce fraud prevention in place, their fraudulent acts will decrease, so they can’t find holes to manipulate the system.

What Are eCommerce Fraud Attacks?

eCommerce, also referred to as electronic commerce, is business done on online platforms. It is associated with the use of retail websites, where transactions occur using technological devices, such as:

- Personal computers;

- Laptops;

- Electronic tablets;

- Mobile phones.

Meanwhile, eCommerce fraud is a way of using deception to gain financially or by other means. It involves using fake information or withholding some valid information in order to trick another person for profit.

Retailers Can Take These 3 Steps to Protect Their Brands

Here are three crucial steps to take in order to defend against a cyberattack and promote forgiveness with clients.

- Establish a cybersecurity-focused corporate culture.

The reputation of your business and your financial stability are both impacted by cybersecurity. Therefore, be sure that each employee is fully aware of the significance of protecting client data as well as the procedures required to enable robust enterprise security. Because a strong security program involves more than just technology, the people who work on it must continuously be on guard and prepared for the next danger.

Implementing a solid cybersecurity training program is one approach to engaging your staff. This empowers your team to protect your business from attacks since they are frequently the first defence against common strategies like phishing and social engineering.

- Make your security infrastructure tighter.

Strong corporate security requires numerous levels to ensure that client data is secure across all channels, including mobile devices. You’ll need to invest more than the bare minimum to achieve this.

And if your retail company is the victim of a cyberattack, be open and honest with your clients about what happened and the precautions you’re taking to reduce any further danger.

- Assist your clients in safeguarding their data.

The secret to being forgiven is to keep in regular contact with your consumers and inform them of the hazards associated with cybersecurity. You can assist your clients in the following ways, for instance:

- Highlighting how crucial it is to use multi-factor authentication whenever possible

- Sending your clients regular reminders that express your concern for their privacy

- Education ultimately produces knowledge and insight and by extension, forgivability.

Don't Let a Complex Admin Panel Slow You Down

We'll build a user-friendly admin for easy order processing and enhanced marketing and sales opportunities.

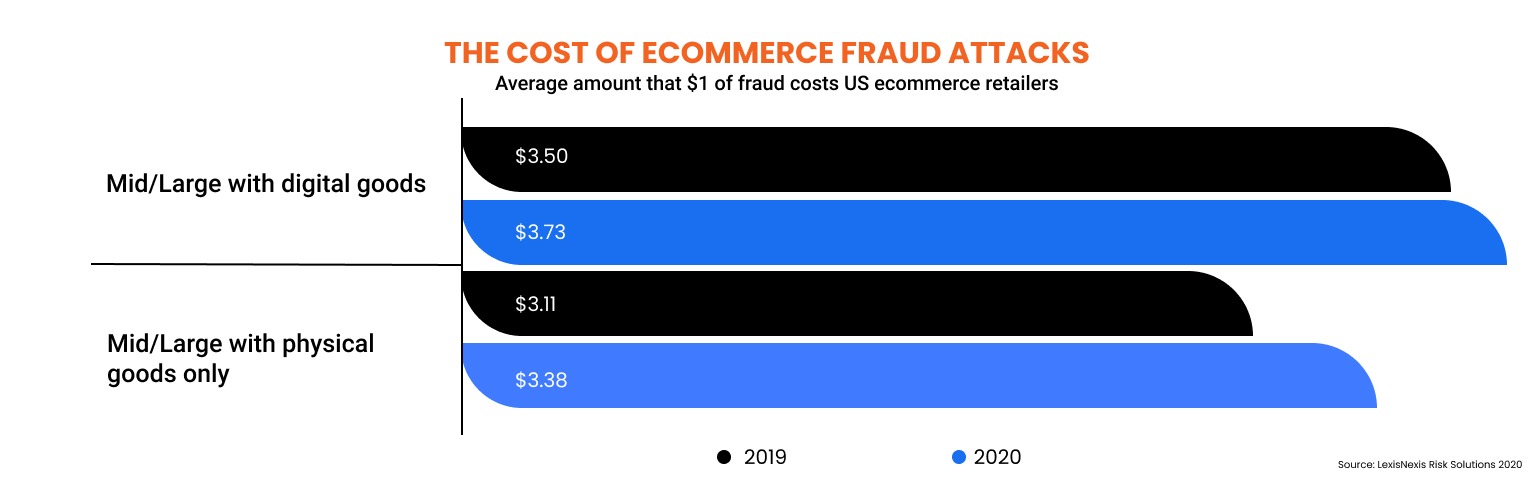

Many reasons exist for eCommerce fraud taking place, but most are due to today’s ease of tricking people online. Due to Covid-19, online fraud has become even more of an issue. Because most people use the Internet more while staying home, fraud cases have massively increased.

Why Does eCommerce Fraud Take Place?

eCommerce fraud happens due to the ease in penetration. Long before the Internet became accessible worldwide, thieves stole credit card information by:

- Breaking into the victims’ homes or even their cars;

- Committing a robbery to a victim in person.

The advantage of this is that police can catch thieves more easily, especially if witnesses are around to testify to the crime. And, of course, executing a theft in person takes a lot of strategic planning in order to not get caught.

Nowadays, however, those involved in eCommerce crime are having an easier time. The information of credit cards and private data have become easily accessible on websites. By going to a website, Internet scammers can get credit card information to get whatever they desire.

Ease

Getting caught is a risk of physically obtaining money or goods. This may include the potential of getting identified by witnesses and CCTV.

But since everything is online nowadays, criminals don’t have to visit a physical store anymore. They can commit eCommerce fraud, obtaining what they want while staying unseen and anonymous.

All that’s needed is a computer or other technological device with an Internet connection. They then have the advantage of operating in any location, at any time.

Anonymity

If there’s one thing criminals are sure of, it’s that the police don’t see eCommerce fraud as a top priority. They can evade capture easily because:

- The money that is handled in fraud transactions is comparatively less than other crimes happening in a city;

- Online fraud transactions can happen outside the country, which blocks the police from capturing them.

These three major reasons increase eCommerce website owners’ guards against fraudulent acts. Hence, they will develop and institute eCommerce fraud prevention techniques.

Evasion

Stealing people’s credit card information is not the only method to execute eCommerce fraud. These other cases of fraud still cause a significant loss to merchants on their website retail store and for each of the victims affected.

The following are the types of eCommerce fraud to watch for.

Types of eCommerce Fraud Attacks

Credit card fraud is the general and overarching term that relates to fraud done by using someone else’s credit card or debit card. The online scammer will use the stolen credit card to visit a website and make a purchase for goods or services.

With such easy access to the World Wide Web, these fraudsters can actually visit sites that sell stolen credit card information. Then they use these stolen cards to buy whatever they want. This then affects the owner of the store because they will have to give a refund due to an unauthorised purchase.

Merchants are also victims of this trickery. An example involves a scam known as the “card testing scam”. Here, a scammer will make low-value test purchases to validate the stolen information they acquired. They will test multiple credit card combinations in order to check which ones are still active, so they can make purchases online.

Credit Card Fraud

Affiliate marketing is when you earn a commission through marketing a product produced by another person. These product or service creators pay you, their affiliate, a commission for sales in exchange for referring other buyers.

It works like this:

- Affiliates use a trackable web link that’s unique to direct buyers to the eCommerce store’s page;

- Buyers will purchase products under the unique link of the affiliate;

- The affiliate will then receive a commission for every successful purchase.

A system like this actually makes it quite easy for criminals to deceive online sellers. They are able to manipulate this system and do so by using fake activities to generate money or even increase the commissions being offered. This is called affiliate fraud.

Affiliate fraud may include things like:

- Generating sales by using stolen credit cards;

- Typosquatting, or URL hijacking, means scammers register domains that are commonly mistyped so they can redirect people to another site;

- Getting people to download adware or advertising-supported software that inserts affiliate code automatically.

Affiliate Fraud

A chargeback is when a buyer requests for the seller to refund a purchase because it’s involved in fraud or is a disputed transaction.

Chargeback fraud is when someone purchases products online with a credit card and receives it. Afterwards, they will demand a refund due to their disappointment with the product (or service).

This obviously creates disadvantages for the merchant selling the goods or services. Typically, this type of fraud happens when the customer demands their money back after weeks or months following the purchase.

Chargeback Fraud

Interception fraud is when the culprit cuts off the delivery of a product from its intended address.

Here is an example: the scammer uses the stolen credit or debit card to purchase what they want online. When checking out, they will enter the original cardholder’s address for delivery. But before the item is shipped, the scammer calls the customer service department. Then they request the delivery address to be changed, giving their own address instead.

This scenario is usually considered reasonable. For example, a valid excuse could be if a buyer is not at home and would like for their friend to receive it on their behalf instead.

Interception fraud

When online accounts that contain personal information are hacked, it causes a terrible situation for the victim. Scammers use phishing techniques to gain access to private information like:

- Financial data;

- Personal information;

- Purchase history.

Some methods of phishing involve using bots. These activities can go unnoticed. But the danger of identity theft haunts and causes devastating effects to the victim. Cybercriminals can use their financial information for more malicious activities in the future.

Phishing/Account Takeover

Online scammers are good at hiding their tracks and movements. However, they are not invincible.

It is possible to identify and stop them before they cause major harm to your eCommerce store and its customers.

eCommerce Fraud Prevention Best Practices

Security audits evaluate how secure an information system that’s owned by a brand or a company is. It measures how well it performs with a set of established criteria.

There are also many types of security audits, such as:

- Risk assessment audit;

- Vulnerability assessment;

- Penetration test;

- Compliance audit.

Always keeping your security measures in check keeps the Internet scammers at bay. It is important to performing regular audits of your site’s security to scan for malware or other areas that criminals might take advantage of. As well, it’s good to check the security of confidential information to prevent its leakage to criminals.

Conduct Regular Site Security Audits

Monitoring your site on a regular basis can ring alarm bells when suspicious activities get spotted. In turn, this will help you to prevent further loss when online scammers attempt to:

- Manipulate the system;

- Use false information that can cause deception.

Be sure to keep track of suspicious activities when:

- Billing and shipping information mysteriously changes;

- Delivery information differs from the physical address of one of your customers.

You can also use tools to help you track IP addresses or anything related to malicious intent.

Monitor Your Site Regularly for Suspicious Activity

Address Verification Service (AVS) will:

- Detect transactions that seem suspicious;

- Use a system to prepare countermeasures to prevent fraud.

Because scammers use stolen card information, the risks for disputed transactions increase. This makes for a very undesirable situation for not only the online store sellers but the original cardholder, too.

To prevent this, the AVS will effectively:

- Traces suspicious activities;

- Reduce the number of customers who demand refunds.

AVS confirms the billing address that’s been entered by a customer matches the cardholder’s billing address that’s on file with the issuing bank. If the billing information doesn’t match, the system will block purchases from the user. Then it flags the transaction for further investigation.

Use an Address Verification Service (AVS)

Hypertext Transfer Protocol Secure (HTTPS) is a combination of:

- Hypertext Transfer Protocol (HTTP);

- Secure Socket Layer (SSL).

HTTPS is more secure than HTTP. This is essential to send data from a customer’s Internet browser to the online store of the merchant.

To secure private data like client names, locations, and credit or debit card information, HTTPS converts it to code. It stops the leakage of transactions to cybercriminals from your online store. It can also protect the confidential information of the administrators of online shop merchants.

Use Hypertext Transfer Protocol Secure (HTTPS)

How can you help to further prevent eCommerce fraud? You can set limits for the number of purchases and total amount of money you are willing to accept from customers in any given day. You can base your threshold on your products and their value.

This will help you to:

- Keep your customer’s transactions in check;

- Avoid massive damage relating to cybercrime activities regarding your online store.

Set Limits on Purchases

As with fraud prevention, IP addresses will help determine whether a purchase is fraudulent or otherwise.

Carefully check the following, and check twice at the least:

- The customer’s IP address;

- The address on the credit card address.

This can help you spot suspicious activities when both addresses differ.

Check that the IP Address and Credit Card Address Match

Keep track of activities in your online marketplace, or even in your own online spending, can help you to prevent eCommerce fraud. As cybercrimes are becoming more common, it’s important to remain vigilant.

Fraud happens when culprits present false information to swindle their victims. And this can be done through the use of many methods. eCommerce fraud happens because it is far easier than the old and much riskier way of stealing. This provides convenience to fraudsters while staying incognito due to its:

- Ease;

- Anonymity;

- Evasion.

Cybercriminals are clever in their deception to steal information, which is part of the key to the success of their fraudulent acts. This is why both sellers and buyers should watch out for falsified data. Stay watchful by doing the following things.

First, always keep the security of your websites in check, which prevents:

- Criminals from taking away sensitive customer information;

- Your online store from suffering huge losses.

Second, always stay alert of suspicious activities that arise, such as inconsistencies in:

- Delivery location and/or the customer’s address;

- The ordered products and amounts.

Stay on top of the activities of your eCommerce marketplace and be careful with what you do online. eCommerce fraud can be prevented so that you’ll be safe on the World Wide Web.

Let us solve your tech challenges!

Summary of eCommerce Fraud Prevention Best Practices and Techniques

Is A High Abandonment Rate Affecting Your Business?

Our solution includes a new theme with a hot feature set to re-engage customers and boost sales.

eCommerce fraud is when a criminal or fraudster uses stolen payment information to conduct online transactions without the account owner's knowledge on an eCommerce platform. Purchase fraud is another name for it.

Purchase fraud, also known as eCommerce fraud, is when thieves or fraudsters perform illicit money transactions on a website without the account owner's knowledge, by using: The use of a false identity. Credit card that has been forged or stolen.

The following are the most common AI eCommerce fraud prevention techniques: Data mining is used to automatically categorize, cluster, and segment data, as well as uncover relationships and rules in the data that may indicate intriguing trends, such as fraud tendencies. Expert systems encode expertise in the form of rules for identifying fraud.

The following is a list of eCommerce fraud prevention techniques that businesses may use right now: Conduct Regular Site Security Audit; Monitor Your Site Regularly for Suspicious Activity; Use an Address Verification Service (AVS); Use Hypertext Transfer Protocol Secure (HTTPS); Set Limits on Purchases; Check that the IP Address and Credit Card Address Match.